Abra Review: The Modern Way of Investing? [Tutorial 2023]

The investment scene is changing. It is opening up.

And this Abra review will show you how the Abra app does just that.

Once upon a time, if you had hard-earned money you wanted to invest, you would need to buy rental properties, contact your stockbroker, or load up your retirement portfolio.

This is all being changed by cryptocurrencies, smart contracts, and companies like Abra.

I will cover this and much more in this Abra app review.

Let’s dive in!

Brief How-To

Before I develop this Abra wallet review, here is a summary of the steps to follow to open an account on the Abra app and get into fractional investing.

- Download the app.

- Put in your name.

- Text message to verify your phone number.

- Select whether you’re a U.S. citizen or not (U.S. investors have access to different assets due to regulations)

- Write down your recovery phrase. This is very important, don’t take this step lightly.

And that’s it! Five quick steps and you are ready to start.

And this Abra review would be incomplete without mentioning that Abra itself has a number of excellent video tutorials to guide you.

Abra (ka-dabra!), The Start And Background.

Abra was founded in 2014 in a place where most innovative apps are born: Silicon Valley.

The founder was none other than Bill Barhydt, who used to work for Goldman Sachs as a software engineer. He also happened to be the former director of Netscape.

In September 2015, Abra received $12 million in Series A funding from RRE Ventures and Arbor Ventures.

But the real progress in innovation happened in March 2018, when Abra added support for 20 new cryptocurrencies such as Litecoin (LTC), Ethereum (ETC), Bitcoin Cash (BCH), and of course the king of crypto: Bitcoin (BTC).

Source: steemit.com/abra/

It was this move that inspired me to try Abra firsthand and put up this detailed Abra Review.

That and reading the Wall Street Journal in June 2018 when Abra was listed as one of the "Top 25 Tech Companies to Watch in 2018".

Since then, Abra has even appeared on Apple Music’s “Planet of the Apps” show.

Perhaps that’s because Abra not only launched crypto on their platform -- but also partnered with Simplex to allow customers the ability to buy bitcoin using Visa/MasterCard on Abra website and app.

All this helps Abra to become a platform allowing anyone to buy, sell, and trade cryptocurrencies -- and most importantly -- get into fractional investing. Maranda Marquit at U.S. News explains how fractional investing works:

“Rather than buying an entire share, fractional investing relies on the idea that you can buy a portion of the stock. For example, if SPY costs $300, but you only have $150, you can use that money to buy half a share. You don't have to purchase the entire share at once.”

This is the genius behind one of the fundamental properties of Bitcoin. It is divisible.

We explain it fully in our ultimate 101 Blockchain guide. Put simply, you don’t need to spend $9,000 dollars (current price for 1 BTC) for one Bitcoin.

You can buy $5 worth of bitcoin -- and Abra allows you to do just that.

Abra’s Missions

"Abra gives you the freedom to invest in multiple cryptocurrencies and fiat currencies. If you are a non-US user, you will also have the ability to invest in stocks and ETFs.”

There you have it, straight from Abra.

Financial freedom is what many of us are after -- The ability to do what we want with our hard-earned money.

A second feature is Abra’s ability to make sure that you hold the keys to your funds.

You have complete control over your money. Whether your Abra wallet holds fiat from your local country or your Bitcoin, Litecoin, Bitcoin Cash, or Ethereum -- you will have the keys to it.

Granted, this comes with a great deal of responsibility. So take a moment away from this Abra review to learn how to keep your keys secure.

Fees and Costs

I’ve used various exchanges and mobile wallets in my day: Coinbase, Kraken, Binance, and more.

At Cryptomaniaks, we’ve also reviewed quite a number of them. So how about Abra?

In this Abra review, it’s essential to examine the fees and costs. To do so, have a look at this handy table chart directly from Abra.

As you can see, the fees and costs are fairly standard.

Abra’s spreads

That said, it’s important to note that Abra makes money from widening the spread between crypto and fiat. They explain this as such:

“We don’t currently charge fees on currency exchanges, but Abra does generate an exchange rate income on the spread between different currencies, which goes to cover some of our costs. For instance, if you convert US Dollars to Bitcoin, or Ethereum to Ripple, there will be a small spread built into the exchange rate that you will see on the app.”

As far as I can tell, there's about a 1% exchange spread. When buying, it will be marked up around 1%, when selling, it will be marked down around 1%.

Credit card fees

Do watch out, though. The fee for buying crypto with your credit card is not light, as Simplex charges a 4% fee with a $10 minimum.

The spot to watch out for here is that the $10 is the MINIMUM FREE, not your buying minimum.

Indeed, the minimum you can buy is $50 worth of crypto. But instead of charging you $2 (which is 4% of $50), they will charge you $10. So the 4% fee is only for $250 or more of a purchase.

Pros & Cons Of Abra

Pros and cons lists are my favorite type of lists. Grocery lists aren’t bad either (I love food), but they don’t apply here. So let’s quickly run this Abra review through the Pros and Cons points.

Pros of Abra

- 100 + new cryptocurrencies in the U.S. and 200 + new cryptos internationally on Abra. That is a wide selection. Researching through 100+ coins will keep your research busy for a long time.

- Fees are low. Unlike other wallets, Abra does not charge when depositing with a bank account. The only fee is the spread which is a reasonable ~1%

- One spot to invest in ETFs, stocks, and cryptocurrencies.

- Supports 70 fiatcurrencies -- excellent news for people around the globe.

Fiat

Paper money issued by governments as default currency. The US Dollar, Japenese Yen, Chinese Yuan, and Euro are all fiat currencies. - Very user-friendly. The screenshots from my Abra app review show that Abra has speed, security, and a good exchange without much of a hassle.

Cons of Abra

- The fee is 4% with a min. of $10 for anyone who wishes to purchase cryptocurrencies with their VISA or Mastercard. So if you’re buying less than $250 with your credit card, the fees can be tough to swallow.

- As a U.S. resident, there will be limitations on your account. You won’t be able to invest in any stocks or ETFs. And even though you’ll have 100+ cryptocurrencies to choose from -- that’s still half of the 200+ available to people outside the U.S.

I Tested Abra; This Is My Ultimate Abra Tutorial

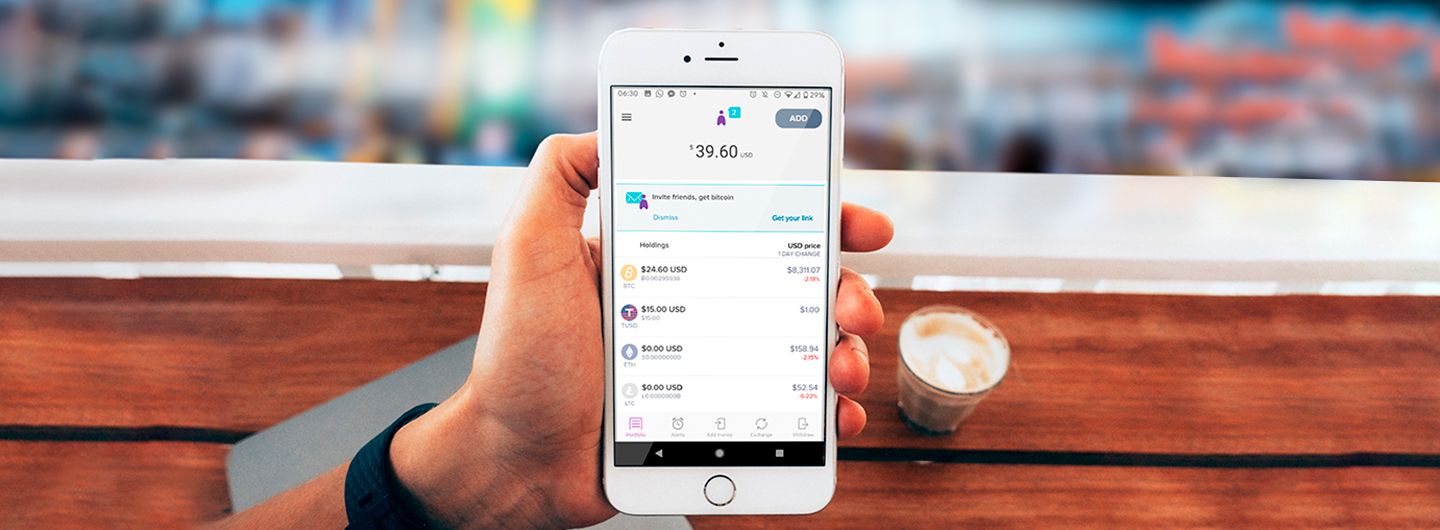

After signing up using the 5 steps I described earlier, I found a number of useful features.

This is the first thing you see when opening the app -- the prompt for your PIN.

I know it’s basic, and most Abra reviews would probably not mention it, but I did. Why?

It’s such a basic step that people often forget how important it is. I can’t count how many times I’ve set a PIN and then forgotten it. So make sure to take a moment and write your PIN down somewhere secure.

Then, there’s a friendly prompt from the Abra wallet. “New feature: change the display currency!”

I find this useful too because sometimes, I want to know the value of my portfolio in other major world fiat currencies, like the Euro.

Now I wanted to test out Abra’s deposit features.

This Abra review would not be complete without it since we all have a little crypto here and there.

I, for one, got an airdrop from Stellar Lumens. So I wanted to see how easy it would be to deposit it and report about it in this Abra wallet review.

Here are two things I realized:

- Abra has your back. They inform you that the address is only for Stellar Lumens, which is good for the user experience. This is a great reminder because if you’re transacting XLM but make the mistake of depositing in your XRP wallet, you’ll lose your funds.

- The second screenshot shows that you MUST include a memo when transfering your XLM. For people who are only used to transferring Bitcoin, note that some cryptocurrencies (like XLM and XRP) need a memo in certain cases.

And as you can see in these two additional screenshots, Abra makes triple certain that you are doing what you need to be doing for a successful transfer.

They even include a QR code, which scores points in this Abra review because it makes our (customers) life even easier.

Success!

Now here’s another useful feature: price alerts.

I have this on my Coinbase wallet (another great crypto exchange). When I’m looking to do a bit of trading (trading every major price swing), then I set a price alert, and buy or sell accordingly.

The next feature I wanted to test out for this Abra review was exchanging my crypto. I decided to trade them for the king of crypto, Bitcoin.

So I went to the exchange and put in my XLM for BTC.

Another useful prompt. Network fees, or “mining fees” are always present in the crypto space. It’s how the network -- and our value -- are secured.

I do wish a little that Abra would let me choose the network fee (high, medium, or low). Fortunately, the cost is negligible most of the time, so it’s not a big con.

Keep in mind that Abra also expects a minimum exchange amount for crypto to crypto exchanges. It’s $5 -- which is not unreasonable.

I increased my XLM to $5 and was able to make the trade in a snap. Another plus for this Abra review.

Now that we’ve seen how simple it is to transfer crypto with Abra, let’s look at actual fractional investing. After all, that’s something important to me in this Abra review.

First, let’s take a look at linking your bank account. Fortunately, Abra made the process quite user-friendly.

There’s my XLM, sitting safe. Now, I want to add my bank account and deposit $5 or more.

Look at the bottom of the screen, where it says “add money” -- tap it. You’ll be brought to the identity verification screen.

To verify your identity and prove you’re the owner of your bank account, Abra partnered with Coinify.

Coinify is a stalwart company established in 2014 for the express purpose of providing secure KYC

and AMLKYC

Know Your Customer. Information gathered by cryptocurrency exchanges in compliance with AML (Anti Money Laundering) laws.compliance for companies around the globe.AML

Anti-Money Laundering. AML laws and restrictions require exchanges to obtain personal information about their customers and their activities.They have a reputation for keeping user data locked tight while providing smooth customer service to clients and businesses alike.

Because I’m in Europe, Abra suggests that I buy with a SEPA transfer. If you’re in the U.S., then this will be a different suggestion for you.

Nevertheless, the process with Coinify ID verification should be the same.

The steps are that simple. Just tap to continue and follow the instructions. I have no screenshots of this due to keeping my info private, but the process is a breeze.

They email a verification code to you. Put that in. Then you’ll snap a pic of your ID and a recent utility bill or other proof of address such as a bank or card statement. Wait a bit, and you’re done.

After verifying your identity, add your bank account. To do that, go to the top-left dropdown “hamburger” icon, and select “Bank accounts.”

Another short verification process. Then… done.

After that, add the money. I chose to add $15. Not much at first, because I want to test it.

I was quite pleasantly surprised. Took just a day to transfer it over.

Zero fee and ready to begin my journey into fractional investing.

Another option, if you don’t want to go the bank route -- is to use a VISA or Mastercard.

Simplex is another strong partner of Abra. They process credit card payments across the globe. The process is even simpler than adding a bank account.

But keep in mind that they charge 4% of your order with a minimum of $10. So you’d need to order $250 or more of bitcoin before the fee dropped to 4%.

Now, to continue testing Abra, I’ve decided to withdraw some of my BTC to another BTC wallet.

Step one, go to your portfolio.

My BTC is sitting safely. Now, I want to transfer it out, so I go to withdraw (bottom right) and select Bitcoin. I’m now presented with this screen:

You can manually input the bitcoin address you want to send your BTC to (though I advise copying/pasting it and double-checking it, always), or you can simply scan the QR code.

I chose to scan the QR code of my new address.

You’ll be brought to the next screen, which is a confirmation screen. There you can check to see if all your details are correct.

Once you’ve double-checked the details, click “Confirm withdrawal” and your BTC is on its way.

Keep in mind the network fee and time it will take to transfer. Sending BTC costs a little bit and it takes a little bit of time.

Though thankfully, it’s not like Western Union or other money transfer services that cost $25+ and take 2-3 days or more.

Bitcoin sending costs anywhere from a few pennies to a dollar and generally takes anywhere from a minute to 15 minutes.

If you want to remember your past transactions in the future, you can always go to the transaction details.

You’ll also see how much the network fee was, and even check all this with a 3rd party blockchain explorer. In my case, the fee was 0.00000583 BTC -- which is roughly 0.05 cents.

There you have it. This Abra review shows how the actual process works, from registering your Abra account to using it.

And since I’m guiding through all the steps, let’s also take a look at how selling BTC looks on Abra. After all, once your BTC purchase rises in value -- you should think about taking profit and selling.

First, tap on “exchange” at the bottom of the screen. Then, select BTC. In this case, my BTC has gone up in value, so I’d like to cash out into a stable currency -- the US dollar. In the Abra app, you would select TUSD (True USD)

Abra shows you the exchange rate. Select how much BTC you’d like to sell/exchange for TUSD, and click “Review.”

After you do that, Abra -- looking out for you -- will ask you if you’re certain.

Everything looks good? So I hit confirm. A welcome “success” screen will appear.

Now, a note I must mention in this Abra app review:

Sometimes, the order does not complete straight away. In my case, it did not.

So I had my prior balance of $15 TUSD available to spend -- while the $48.87 of TUSD I had just gained from my sale of BTC was still pending.

Not to worry, the confirmation arrived soon enough, and I had all my funds confirmed and read to buy or withdraw with.

That about sums it up, ladies and gentlemen. A couple of features I couldn’t mention (but are nonetheless important) for this Abra app review:

- Users outside the U.S. can also invest in stocks and ETFs. I registered as a U.S. user, so I couldn’t review that. But it promises to be another solid investment vehicle to help you diversify.

- Abra is more secure than most cryptocurrency exchanges because the Abra wallet is a non-custodial wallet. This means that Abra never has access to users’ funds or their recovery phrases.

Overall I found the Abra experience to be easy, quick, and worth my time and effort.

It’s good to have such a solid wallet where I control my own keys -- as well as an exchange with reasonable fees and transfer times.

Abra earns my recommendation.

Abra Review: Final Tips & Summary

Compared to other alternatives out there, Abra is a solid choice as a fiat/crypto wallet and investment platform.

It will be a good complement to the wallets I already have installed. It will help me diversify and will make me feel secure about my investments.

Simply take good notes of my most important tips:

- Purchasing crypto with your credit card only if it’s over $250. But most importantly, always use your bank account to deposit when possible.

- Keep your recovery phrase and PIN written down and stored safely. These responsibilities come with the territory of financial freedom.

In the end, I must say, it’s good to see the cryptocurrency space growing with legitimate, consumer-focused services such as Abra.

I believe Abra will play a role in onboarding the masses coming in 2023.

Good on you for reading this article and educating yourself while the cryptocurrency sphere is still relatively young.

More Great Resources:

- The 3 Best Sites To Earn Interest On Crypto

- The 7 Best Bitcoin Sportsbooks

- The 10 Best Cryptocurrencies To Invest In

- The 17 Best Crypto Tools

- Own a website? Link to this article!

- Willing to spread the love? Share it on social!